Standard insolvency for companies 2023 - requirements, duration & process

Standard insolvency proceedings - what is that?

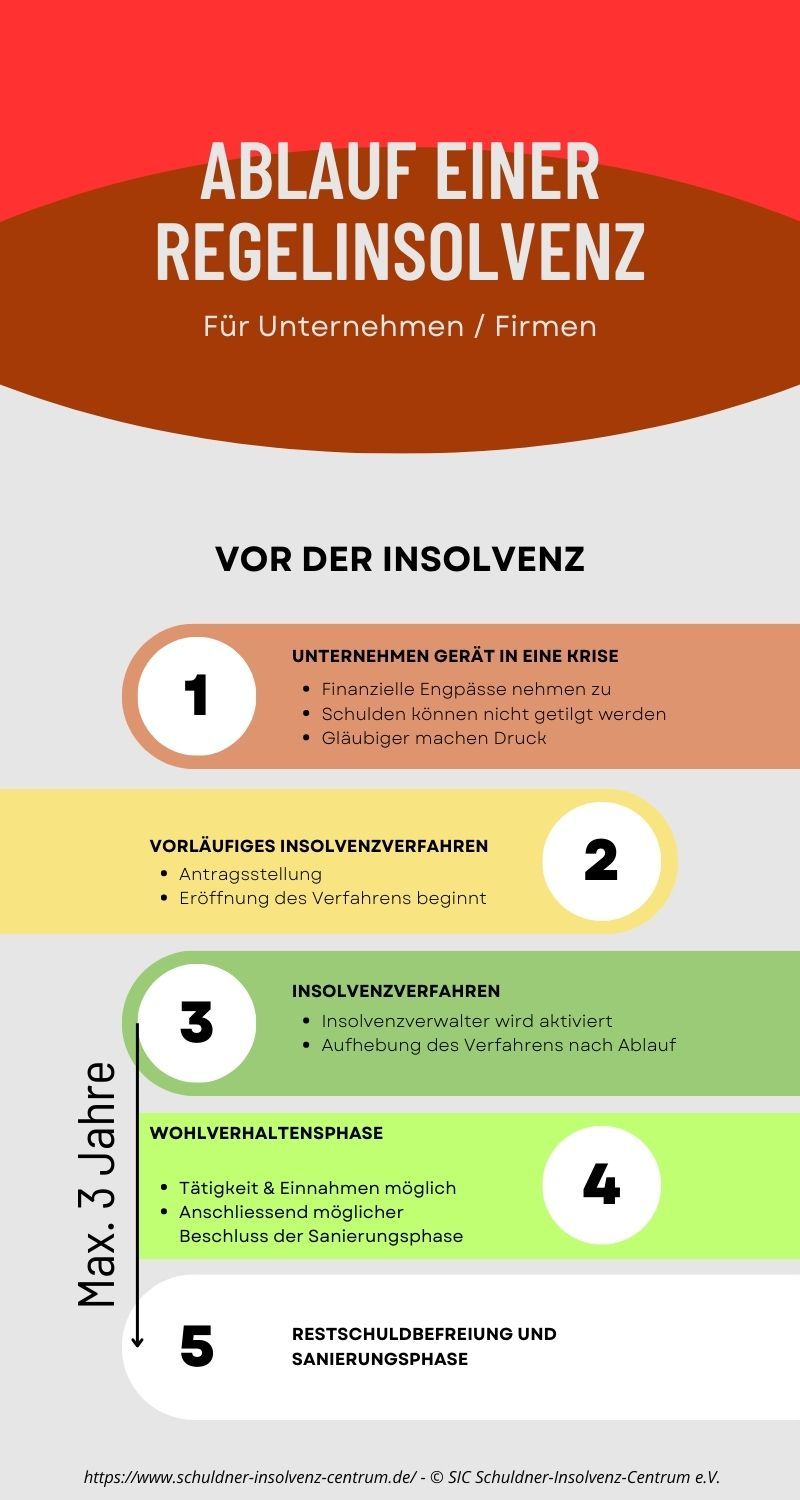

In Germany, standard insolvency is the general insolvency procedure for entrepreneurs, companies and businesses.

Standard insolvency proceedings offer self-employed natural persons (entrepreneurs and freelancers) the opportunity to free themselves of all debts after a maximum of three years (the so-called residual debt exemption).

Summary - Standard insolvency for companies in 2023 / 2024

- Continue to be self-employed in a regular insolvency as an opportunityWhen does a regular insolvency have to be used?Where does the regular insolvency application have to be made?Tasks of the company in the event of a regular insolvency - quick overviewAll details on the process of a regular insolvencyProcedure of the regular insolvency as an overview of the infographic:Regular insolvency: First requirementsA discharge by means of regular insolvency is under The following conditions are possible and useful: Process and duration of the standard insolvency: The application for standard insolvency at the insolvency court Advantages and disadvantages of standard insolvency

Continue to be self-employed in a regular insolvency as an opportunity

In addition, you can continue to be self-employed. However, the insolvency administrator must be given a plausible explanation as to how this cannot lead to further debts. Once approved, it is not a problem and even desirable to be able to reduce debt through self-employment.

The continued or opened self-employment ideally increases the chance for creditors to recover part of the claims.

Company insolvency is also a normal insolvency. In the case of legal persons or companies (GmbH, AG, UG), insolvency proceedings end with restructuring (continuation) or alternatively with liquidation (dissolution).

When does a regular insolvency MUST be used?

When companies/companies become insolvent. Or even if the self-employed with more than 19 creditors become insolvent. Then no personal bankruptcy is possible for the self-employed.

Where does the standard insolvency application have to be filed?

The insolvency application must be filed with the insolvency court responsible for your region. In contrast to consumer bankruptcy, it is not necessary to attempt an out-of-court settlement with the creditors in advance.

Important: Professional advice from a lawyer or insolvency advisor is recommended in advance.

Who is entitled to apply for standard bankruptcy?

The special thing about regular insolvency is that both parties are entitled to file an application.

On the one hand there are partnerships (OHG, GbR, KG...) and corporations (GmbH, AG, UG) freelancers but also self-employed.

These parties are creditors and debtors. As already explained with regard to the obligation to file for insolvency, consumers are not obliged to file for insolvency if there is a reason for insolvency.

Tasks of the company in a regular insolvency - quick overview

• Preparation of documents.

• Apply to the bankruptcy court.

• Appointment of an insolvency administrator.

• Convene a meeting of creditors.

• Asset recovery and debt settlement.

These are the three steps of the standard insolvency procedure

1. Opening procedure

2. The actual bankruptcy proceedings

3. The Completion of the Procedure

All details about the process of a regular insolvency

Normal insolvency lasts between 3 and 6 years. Insolvency proceedings end with the restructuring or liquidation of the company. In order to open insolvency proceedings, an application must be submitted to the insolvency court. There must be a reason for insolvency.

Standard insolvency: First requirements

Insolvency must be opened by means of a standard insolvency application.

The insolvent company or self-employed person can apply for regular insolvency. The creditors are also entitled to apply.

Insolvency: The debtor is unable to pay the debts that are due. He may have stopped making payments.

Debt relief by means of regular insolvency is possible and sensible under the following conditions:

In the absence of an opportunity to settle debts due to insolvency - debts can no longer be repaid.

Imminent insolvency also makes regular bankruptcy sensible. Section 18 sentence 2 InsO sets “a forecast period of 24 months as a basis”.

In the case of over-indebtedness: The debtor's assets are not sufficient to settle all liabilities. When going concern is considered extremely unlikely in the following 12 months.

In the case of self-employment

A consumer bankruptcy would then be the more appropriate type of procedure

The center of your life should be in Germany

At the time the regular insolvency proceedings are opened, this is a prerequisite (§ 2 InsO https://www.gesetze-im-internet.de/inso/__2.html).

After opening the first appointment with the insolvency administrator, you can move abroad if you wish.

Rare alternatives and exceptions

There are more than 19 creditors from a self-employment (which was exercised earlier) (§ 305 Para. 1 InsO)

The insolvency court decides on the possible start of the standard insolvency:

A consumer bankruptcy would then be the more appropriate type of procedure

The center of your life should be in Germany

At the time the regular insolvency proceedings are opened, this is a prerequisite (§ 2 InsO https://www.gesetze-im-internet.de/inso/__2.html).

After opening the first appointment with the insolvency administrator, you can move abroad if you wish.

Duration of regular insolvency:

This usually lasts one to two years. This depends on the effort involved in checking all business documents, as well as the amount of debt and remaining capital. The entire insolvency procedure ends for the respective company // corporations.

Application for regular insolvency at the insolvency court:

This must be provided by at least one member of the responsible “representative body” (e.g. CEO, board of directors...). Or by a believer.

>> You can download the application as a PDF here <<

Obligations during this so-called good conduct phase are:

>> The standard insolvency was applied for and the three-year phase of good conduct starts on the day the proceedings are opened. During this time, the acquisition and notification obligation applies. The insolvency administrator must be informed immediately during this phase if income or living conditions change.

Opportunities for business activities and income:

From starting a business to continuing self-employment, there are opportunities to reduce debt faster even during regular insolvency. The continuation

Completion of the regular insolvency proceedings:

Since October 2020 maximum after 3 years. The previous procedures took 3, 5 or 6 years depending on the rate of debt repayment (repayment).

Instead of claiming the standard insolvency, you can try to reach an out-of-court settlement. If this comparison is successfully completed, you will be free of debt much faster. On average, it only takes about three months to complete the settlement and be debt-free. However, this only applies if you can make a one-off payment. If you agree to an out-of-court settlement with an installment agreement, it takes just as long as with a regular insolvency.

If the requirements for an insolvency plan are met, you can become debt-free within a year. This is often cheaper in the long run.

What special features apply to employment contracts during the procedure?

The employment contracts continue despite the opening of insolvency proceedings. The employer's rights and obligations can be assumed by the insolvency administrator. The debtor only remains legally in the employer position if the insolvency court orders self-administration. This can be done in the opening order at the request of the debtor with the consent of the creditors.

employee's social insurance

The obligation to pay contributions to health, pension, nursing care and unemployment insurance remains unaffected by the procedure. In principle, the contributions to accident insurance can be omitted. But only if the employees are released from work until the end of the employment relationship when the insolvency proceedings are opened.

Insolvency money from the Employment Agency

If the employer can no longer pay salaries, the employment agency will, under certain conditions, cover the outstanding wage claims.

This happens in the form of insolvency money according to § 324 paragraph 3 sentence 1 SGB III.

There is an entitlement to insolvency money in the event of an insolvency event (e.g. opening of insolvency, refusal to open insolvency due to lack of assets) for the preceding three months (insolvency money period) of the employment relationship. Within a limitation period of two months after the insolvency event, employees can apply for insolvency benefits at the responsible employment agency.

The employment agency in whose district the payroll accounting office responsible for the employer is located is responsible. The application can be made there up to a maximum of 2 months after the start.

Further information: https://www.arbeitsagentur.de/unternehmen/finanziell/insolvenzgeld

termination of employment

The notice period is three months to the end of the month, unless a shorter notice period has been agreed; however, a longer notice period is canceled out by the standard insolvency.

This shortened notice period applies to all longer notice periods, regulations and limitations or other types of agreements. Regardless of whether the legal or collective bargaining basis of the respective employment relationship, the insolvency regulations take precedence.

Pros and cons of bankruptcy

Advantages

- Self-employment can be continued and entrepreneurship as well. It can also make sense for natural persons to continue working as managing directors. Everything becomes more calculable, because the maximum duration and also the money that remains to live on is fixed. The financial basis of life is protected by garnishment exemptions in the so-called P account. Protection against creditor claims. As a result, reminders and enforcement notices are not sent by post. That relieves a lot.Financial new start possible: The regular insolvency enables indebted companies and companies to start a new economic start after the process has been completed, since they are freed from most debts.

Disadvantages

- Insolvency publication: Under insolvency notices, everyone can see who is going through insolvency proceedings.Schufa entry: This is only deleted three years after the discharge of residual debt.Public registration with SCHUFA entry: The fact that you are going through a regular insolvency is entered in the insolvency register and is therefore publicly visible. This can affect reputation and creditworthiness. The entry will only be deleted three years after the residual debt has been discharged.Loss of assets & attachments: During the insolvency proceedings, the insolvency administrator can realize the debtor's attachable assets in order to satisfy the creditors. This can result in the loss of financial assets, such as real estate or vehicles. Lengthy process: Normal insolvency is a complex process that can take several years. During this time, the debtor is bound by certain specifications and obligations. Decreased chances of getting credit: After a regular bankruptcy, it can be difficult to get credit or loans in the foreseeable future as creditworthiness can be significantly affected.

Get professional advice from a Debt & Insolvency Advisor with over 10 years of experience.

⟟ Hauptstr. 115

70771 Leinfelden-Echterdingen

☎ 0711 16036757

✉ poststelle@mail-sic.de

- Insolvency advice

- Private insolvency

- Corporate insolvency

- P-account certificate

- garnishment allowance

- Credit without Schufa

- Admission form

- NOW discover insolvency application cost reimbursement protection

- Coching in Cyprus

- Mon - Fri

- - -

- Saturday

- -

- Sunday

- Closed

*Appointments on Saturdays only on the first Saturday of the month and only for employed persons or self-employed persons if an appointment during the week is not possible. Telephone calls cannot be accepted on Saturdays! Sunday and public holidays closed.