bankruptcy proceedings | SIC Debtor Insolvency Center e. V

Der SIC Schuldner-Insolvenz-Centrum e. V. begleitet Sie in Ihrem Insolvenzverfahren bei jedem Schritt.

How does an insolvency proceeding work?

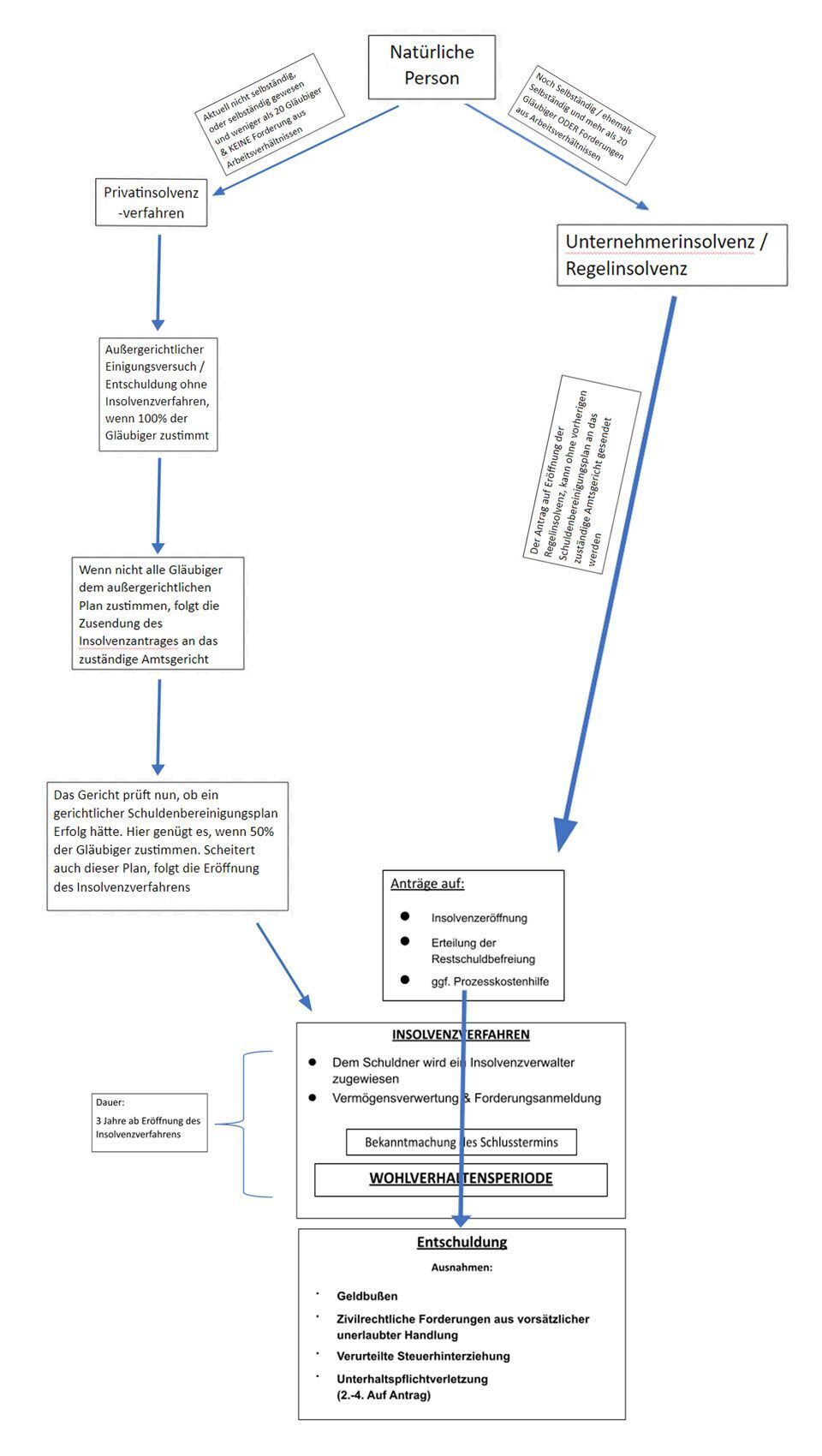

Before the actual insolvency can start, the debtor must first try to reach an out-of-court settlement. Creditors must be informed of how the debtor plans to settle their debt. If this attempt fails, the insolvency proceedings move on to the next phase. The debtor can now file for personal bankruptcy with the competent court.

If the application is accepted, the insolvency court initiates another attempt at an agreement. If the creditors do not agree with this either, the actual insolvency proceedings are opened. At this point, an insolvency practitioner is appointed by the court who is responsible for the realization of the debtor's attachable property. Once the insolvency estate has been distributed to the creditors, the closing date follows. If there are no objections, the official procedure is closed.

The Obligations of the Debtor

From the opening of the insolvency proceedings, the so-called good conduct period begins. During this period, the debtor must follow strict rules. Among other things, he must not accumulate new debts. When this phase comes to an end, the remaining debt can be discharged. All outstanding claims against the debtor become invalid and he can start debt-free in the future.

Insolvency proceedings run for three years if the debtor filed for insolvency on or after October 1st, 2020. However, the required preparation time must be added.

Course of an insolvency procedure: There are two possible options

| Option 1 | Option 2 | |

|---|---|---|

| Starting point "natural person" | Still self-employed / formerly self-employed and more than 20 creditors OR claims from employment relationships | |

| Possible types of bankruptcy | personal bankruptcy proceedings | Entrepreneurial insolvency / regular insolvency |

| attempt at agreement | ||

| Apply to the competent district court. This happens because as a result of the lack of consent of all creditors | Apply to the responsible district court for the opening of standard insolvency. This can be submitted to the competent district court without a prior debt settlement plan | |

| initiation of the initiation of proceedings | Examination of insolvency by a court and whether a debt settlement plan would be successful. Here it is sufficient if 50% of the creditors agree. If this plan also fails, insolvency proceedings will be opened. | Applications for: Opening of insolvency Granting of the discharge of residual debt If necessary, legal aid |

| bankruptcy proceedings. Duration: 3 years from the opening of the insolvency proceedings | Assignment of a trustee / insolvency administrator Asset realization and filing of claims. Notice of Closing Date. WELLBEING PERIOD | Assignment of a trustee / insolvency administrator Asset realization and filing of claims. Notice of Closing Date. WELLBEING PERIOD |

| creditors meeting | No mandatory gathering | Mandatory meeting of creditors |

| bankruptcy plan | Notice of Closing Date. | Opportunity to introduce an insolvency plan |

| end of procedure | Debt relief: Residual debt discharge after 6 years Exceptions: -Fines -Civil claims from willful tortious acts Convicted tax evasion Breach of maintenance obligations (2nd-4th on application) | Debt relief: Processing of the procedure after the debt has been repaid Exceptions: -Fines -Civil law claims arising from intentional tort Convicted tax evasion Breach of maintenance obligations (2nd-4th on application) |

Possible course of an insolvency - additionally as a graphic

ALL necessary downloads & forms on the subject of insolvency can be found here: garnishment table, insolvency checklist, recording form, budget

Read also: Property developer insolvency - recognize signs & react well

The developer is not only responsible for the construction, but also for the sale of the property. Insolvency can affect any property developer. Regardless of size or experience in construction projects.

Property developers develop new construction areas and invest in good locations in order to maximize profits. Property developers take on bank loans and generally high financial investments and the associated risks. This increases the risk of insolvency enormously.

⟟ Hauptstr. 115

70771 Leinfelden-Echterdingen

☎ 0711 16036757

✉ poststelle@mail-sic.de

- Insolvency advice

- Private insolvency

- Corporate insolvency

- P-account certificate

- garnishment allowance

- Credit without Schufa

- Admission form

- NOW discover insolvency application cost reimbursement protection

- Coching in Cyprus

- Mon - Fri

- - -

- Saturday

- -

- Sunday

- Closed

*Appointments on Saturdays only on the first Saturday of the month and only for employed persons or self-employed persons if an appointment during the week is not possible. Telephone calls cannot be accepted on Saturdays! Sunday and public holidays closed.