New Schufa regulation since March 2023 – The most important things at a glance!

Shortened Schufa deletion period after discharge of residual debt since March 28, 2023.

According to Schufa's announcement, the data of those affected will only be stored for six months after the end of a private insolvency. This is Schufa's reaction to a ruling by the European Court of Justice (ECJ) that is currently being processed. Deletion of the residual debt relief entry: now after six months instead of three years!

New Schufa regulation

Table of Contents - Schufa Regulation 2024 / 2025

- The credit agency Schufa shortens the data storage period

- What it means for debtors and who it affects

- Will the Schufa score also be “overturned”?

- The ECJ justifies the critical review with possible violations of the GDPR

- This is how “mysterious” the Schufa score is created: The credit agency and its business secrets

- Schufa has already taken action here

- What does this mean for debtors?

-

The exciting ruling of the European Court of Justice (ECJ)

The credit agency Schufa shortens the data storage period (for private insolvency) to six months!

Schufa has announced an important change for people who have gone through personal bankruptcy : instead of the usual three years, data will now only be stored for six months after a completed personal bankruptcy . This step is being taken in anticipation of an impending ruling by the European Court of Justice (ECJ).

With this change, Schufa wants to create more "clarity and security for consumers ," according to a Schufa spokeswoman. The change will take place immediately (the process will be changed by the end of April 2023), even if the technical adjustment may take a few more weeks. This means that people who have settled their debts through personal bankruptcy will have the opportunity to leave their financial past behind more quickly.

What it means for debtors and who it affects.

The reduction in the storage time of data after private bankruptcies at Schufa will affect an estimated 100,000 people in Germany each year . Although there are many people in Germany with financial problems, only a few take advantage of the option of bankruptcy, which often enables faster debt relief and should actually be common practice.

The change will also affect those who use Schufa entries to make decisions , such as landlords or lenders .

In the past, the long storage time of the Schufa made it difficult for consumers to start over after a personal bankruptcy. This made it much more difficult to conclude contracts, make purchases and take on new debts, which are often necessary in entrepreneurship.

Although those affected had paid off their debts through bankruptcy, their financial reputation was usually affected by the Schufa entries . This meant that lenders and banks were often hesitant to grant loans when they saw that someone had gone through bankruptcy.

The new regulation now allows those affected to enter into new obligations more quickly, such as renting a new apartment or taking out a loan. " The shortening of the storage time improves the situation for debtors overall," say experts.

However, it should be noted that this change also increases the risk that people will get back into debt more quickly. Neither the discharge of residual debt nor the reduction in the storage period are linked to financial advice.

It is therefore important to act responsibly when taking on new commitments.

Even after the decision, there were significant effects on stored data for some consumers. In March/April 2023, as a result of the change, Schufa said it deleted entries from around 250,000 consumers who had gone through personal bankruptcy.

Further details on the Schufa decision and the announced ECJ ruling follow in this article:

Will the Schufa score also be “overturned”?

An expert from the European Court of Justice (ECJ) also found that Schufa violates European law by creating score values for creditworthiness. This was recently widely published in the media (here Tagesschau). (LINK: https://www.tagesschau.de/wirtschaft/finanzen/schufa-scoring-verstoss-eu-recht-101.html )

The ECJ justifies the critical review with possible violations of the GDPR (General Data Protection Regulation)

An expert from the European Court of Justice (ECJ) has stated that the score values created by Schufa, which assess a person's creditworthiness , violate EU law with regard to the GDPR . Schufa's storage of entries from public insolvency registers has also been criticized. A ruling is expected to be made in a few months. More information on the possible GDPR violation can be found on wbs.legal .

Score values are created by Schufa to assess how reliably a person meets their payment obligations. These ratings are often used by banks, telecommunications providers and energy suppliers to assess a person's creditworthiness.

Not only financial data are taken into account, but comparison groups are also formed according to age, gender, name and place of residence in order to make the most accurate predictions possible about how solvent a person is.

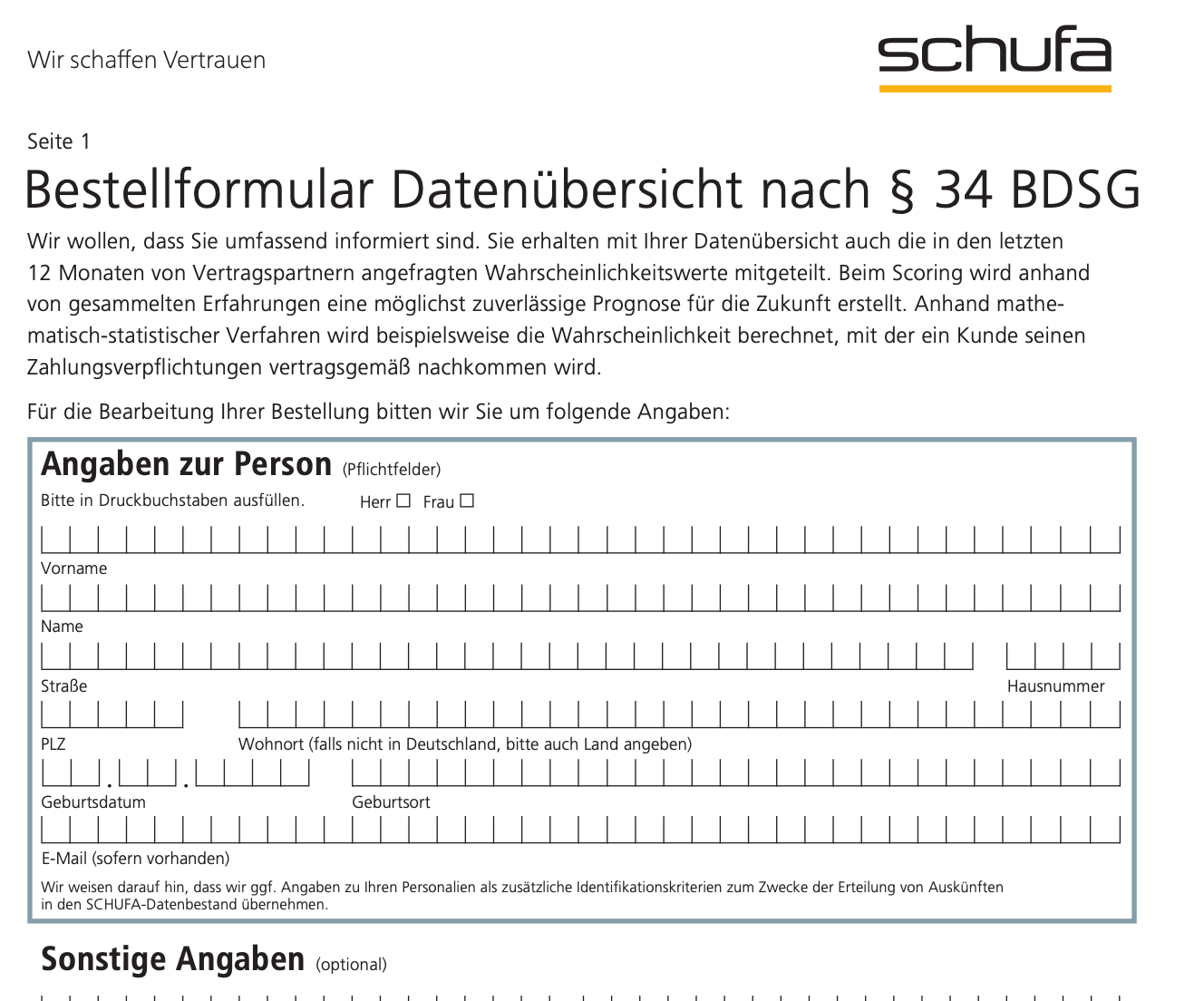

The criticism arose in the context of several cases in Germany. In one case, a person asked Schufa to delete an entry and provide access to the relevant data after he had been refused a loan. However, Schufa only provided him with his score value and general information for the calculation.

This is how “mysteriously” the Schufa score is created:

The credit agency and its business secrets

The method for calculating these values is a trade secret, as the Federal Court of Justice (BGH) decided years ago. The Wiesbaden Administrative Court has submitted the case to the ECJ to clarify the relationship to the European General Data Protection Regulation.

According to the Regulation, decisions that have legal effects on data subjects may not be taken solely on the basis of automated processing of data . The Advocate General found that the automated creation of a probability value, such as the score value, already constitutes such a prohibited automated decision . This also applies when the final decision is taken by third parties, such as banks.

Ironically, Schufa also provides information when it has no information on the people in question . In this case, it simply checks the living environment and draws conclusions from this. How exactly these assessments are made remains a trade secret of Schufa to this day.

However, this could mean further problems for Schufa , as private credit agencies such as Schufa are often used by banks, telecommunications service providers or energy suppliers to obtain an assessment of a person's creditworthiness. A verdict on the score was expected in summer 2023.

What does this mean for Schufa and consumers?

- If the ECJ classifies Schufa’s actions as unlawful, this could have far-reaching consequences.

- Schufa may need to revise its rating system and make it more transparent.

- For consumers, this could mean that their creditworthiness is assessed more fairly and objectively, without personal data and trade secrets being used as a basis.

It remains to be seen how the court will decide in a few months and what consequences this will have for Schufa and other credit agencies.

Schufa has already taken action here

The Schufa decision, which was already implemented in March/April of this year, could affect several upcoming court decisions. The Federal Court of Justice (BGH) announced this year that it was temporarily suspending proceedings in order to await a decision by the European Court of Justice (ECJ) in two similar cases.

One example is the case of a former self-employed person who had to file for bankruptcy in 2013. Consumer bankruptcy allows private individuals to get rid of their debts, even if they are unable to pay everything back.

The so-called residual debt relief is published on an official internet portal for a period of six months . In the plaintiff's case, the residual debt relief was granted in 2019 and recorded on the nationwide insolvency portal. Schufa had retrieved and stored the man's data.

What does this mean for debtors?

Schufa's decision to drastically reduce the storage period for entries from private bankruptcies is likely to have positive effects. Those affected will see their credit rating improve as this information will no longer be stored for as long. This will probably make it easier for them to conclude contracts or make major purchases.

However , it remains to be seen what the court decisions will be in this regard and whether further changes in the handling of Schufa data are imminent.

The exciting ruling of the European Court of Justice (ECJ) is expected in summer 2023.

It remains to be seen whether the ECJ will agree with the Advocate General's proposal on all points. In the past, the ECJ has followed the Advocates General's recommendations in most cases. The ECJ's ruling is expected in a few months and will bring more clarity.

Schufa itself has only made a brief statement on the final submissions . It also remains unclear whether it and other potentially affected private credit agencies will have to adapt their data processing procedures.

The impact of the ECJ ruling on Schufa and other credit agencies will only become clear after the ruling is announced. It will be interesting to see how the industry develops as a result and what consequences this has for the processing and evaluation of personal data.

Criticism continues to come from the managing director of the German Paritätischer Wohlfahrtsverband on Twitter.

He apparently thinks that despite changes, data storage still goes too far. Ulrich Schneider on Twitter, still extremely critical:

" Now hopefully nobody wants us to celebrate, right? This data octopus #SCHUFA needs to be dissolved."

Get to know us - Wolfgang Seelig and his team are personally there for you!

Competent debt and insolvency advice in the greater Stuttgart area

Welcome to the website of the SIC Debtor Insolvency Center e. V. in Stuttgart. We are your contact for all questions about debt and insolvency. Regardless of whether you are facing insolvency proceedings privately or professionally - we will help you professionally. Discover our advisory services and initial information about your options. We are here to help you!"

About Us

Find out more about me and my team at SIC Debtor Insolvency Center e. V. Our expertise is based on personal experience and professional qualifications.

Contact us

Do you have questions about insolvency advice or do you need support? Contact us conveniently via WhatsApp, telephone or email. Our team is ready to help you. Don't hesitate to contact us!